trust capital gains tax rate uk

Income Tax The first 1000 is taxed at 75 dividend income or 20 all other types of income. Discover Capital Gains Tax Rate Uk for getting more useful information about real estate apartment mortgages near you.

The States With The Highest Capital Gains Tax Rates The Motley Fool

Capital gains tax allowance.

. The trust will benefit from the 1000 standard rate band taxed at 20 for the first 1000 of income and gains liable to income tax and the rest of the gain would be taxed at 45. As from April 2016 Capital Gains Tax rates vary depending on the nature of the asset disposed of. For the 2020 to 2021 tax year the allowance is 12300 which leaves 300 to pay tax on.

Trust Tax Rates On Capital Gains 2022 Capital Gains Tax Rate 2022 It is widely accepted that capital gains refer to earnings realized through the sale of assets such as stocks real estate or a company and that these profits constitute tax-deductible income. 12 Offshore trusts The term offshore trust although not legal or statutory is universally used to. The trust deed defines income to include capital gains.

The trust suffers tax at the rates applicable to the trust the additional rate of tax. Highest Income Tax Rate Uk History. Because tax brackets covering trusts are much smaller than those for individuals you can quickly rise to the maximum 20 long-term.

Although irrevocable trusts are complex trusts which means they can accumulate income they make on trust assets the trustees normally reduce taxes by distributing all the trust income each year to the beneficiaries in the year the. A capital gain of 200 that is eligible for the CGT 50 discount. At basically 13000 in income they hit the highest tax rate.

Rate of income tax relief for investors in VCTs will be 30. If this amount places you within the basic-rate tax band you will pay 10 tax on any capital gains. Income Tax Rates 202223 Changes.

The remaining gains are taxed at 20 unless the gain is on a residential property interest where the rate would be 28. Gains which when added to taxable income fall in the UK higher or UK additional rate tax band 20 Capital gains on residential property which is not. Individuals are allowed to deduct up to 12300 from their taxable capital gains.

Any gains arising on trust assets are reduced by an annual exemption of 6150 202021 divided equally by the number of trusts set up by the same individual in existence in the relevant tax year. Capital gains tax deferral relief is also available. Your entire capital gain will be taxed at a rate of 20 or 28 in the case of the residential property provided your yearly income exceeds 50270.

Interest income of 100. Calculating the gain CGT on unit trusts and OEICs is calculated using an average cost basis. Because the combined amount of 20300 is.

Venture Capital Trust VCT maximumb 200000 Individual Savings Account ISA total investment maximumc 7200 stocks and shares ISA maximumc 7200 cash ISA maximumc 3600 a. Targeted at offshore trusts to ensure that UK income tax and capital gains tax cannot be avoided using offshore trusts. Trustees pay 10 Capital Gains Tax on qualifying gains if they sell assets used in a beneficiarys business which has now ended.

A trustee derived the following amounts in the 201415 income year. Any part of the gain which falls within the basic rate tax band is taxed at 10 and the balance will be taxed at 20. For higher-rate and additional-rate you will pay 20.

20 28 for residential property. Such trusts however can still afford tax-planning benefits particularly for those domiciled outside the United Kingdom. The income of the trust estate is therefore 300 100 interest income 200 capital gain and the net income of the trust is.

20 for trustees or for. 6000 divided by the number of trusts settled subject to a minimum of 1200 per trust Capital gains tax rate. Residential Property is taxed at 28 while other chargeable assets are taxed at 20.

Income tax relief restricted to 20. This is subject to change by the government. Lower Income Tax Rate For Companies Ay 2021-22.

Add this to your taxable income. Home Tax Bracket Rates Tax Rate On Capital Gains In A Trust. Given that the top marginal tax rate of 396 and the 38 net investment income tax apply to estates and trusts with taxable income in excess of only 12150 in 2014 not to mention state income taxes the tax impact of retaining capital gains in a trust can be severe.

If the individual is only a basic or higher rate tax payer or has the 5000 0 band for dividends then they are entitled to a deduction to their tax liability. Irrevocable trusts have a major tax issue. For individuals the gain is added on top of their total income to determine the rate payable.

A 10 tax rate on your entire capital gain if your total annual income is less than 50270. The remaining amount is taxed at the current rate of Capital Gains Tax for trustees in the 2020 to 2021 tax year.

How Much Is Capital Gains Tax Times Money Mentor

Long Term Short Term Capital Gains Tax Rate For 2013 2016 Http Capitalgainstaxrate2013 Tumblr Com Post 719 Capital Gains Tax Wealth Planning Capital Gain

6 Awesome Apps To Help You Do Your Taxes Sapling App Corporate Tax Rate Tax Questions

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Top 10 Highest Paid Athlete In The World 2021 Https Www Moneyinternational Com Top 10 Highest Paid Athlete 2021 In 2021 Athlete Mohamed Salah Liverpool Kylian Mbappe

How Do Taxes Affect Income Inequality Tax Policy Center

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments Capital Gains Tax Capital Gain Real Estate Investing Rental Property

The Looming Capital Gains Tax Hike The Potential Impact On Businesses And Individuals Sc H Group

Tax Efficient Investing In Gold

Capital Gains Tax 30 Day Rule Bed And Breakfast

How Do Taxes Affect Income Inequality Tax Policy Center

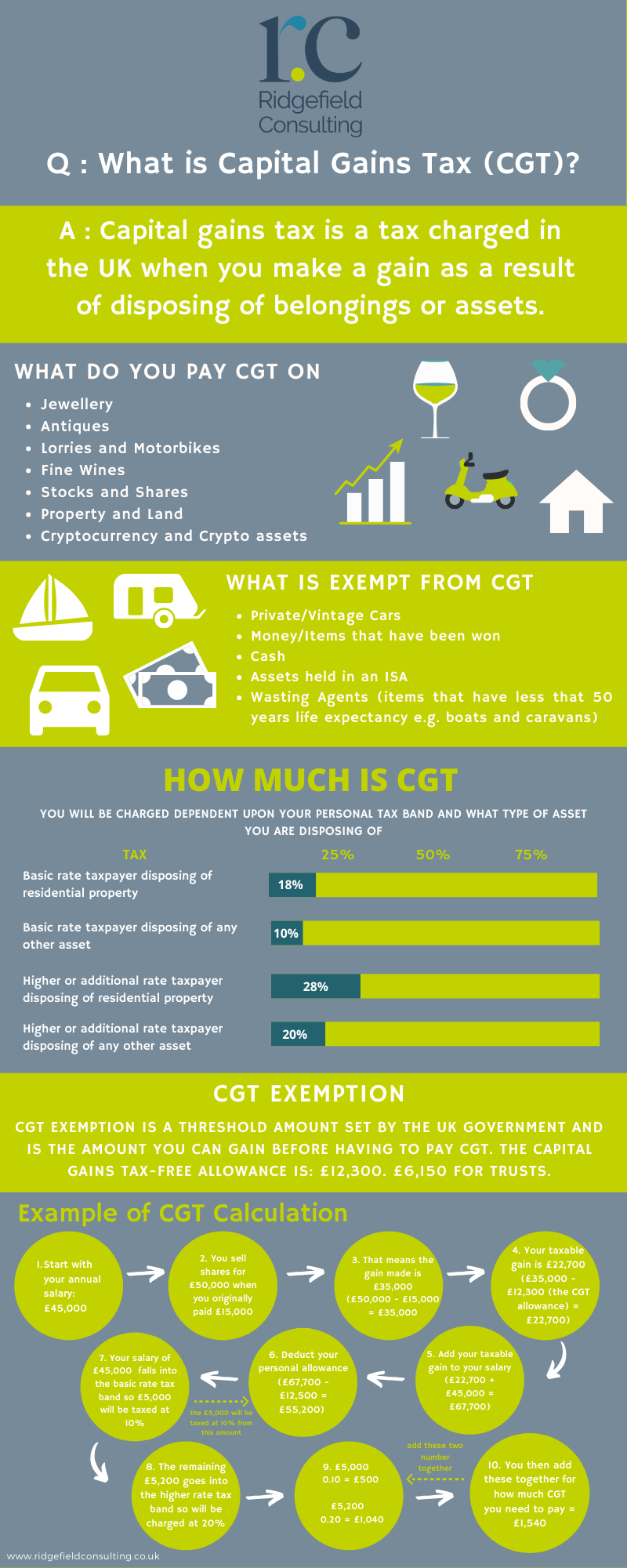

What Is Capital Gains Tax Cgt Ridgefield Consulting

Dns Accountants Is One The Excellent Accounting And Tax Consultancy Services In Borehamwood Uk Having Accounting Services Accounting Professional Accounting

A 95 Year History Of Maximum Capital Gains Tax Rates In 1 Chart The Motley Fool

Capital Gains Tax Spreadsheet Shares Capital Gains Tax Capital Gain Spreadsheet Template

How Uk Budget 2021 Impacts Expats Https Www Moneyinternational Com Uk Budget 2021 In 2021 Budgeting Capital Gains Tax Uk Pension